Financial Management

One of the essential requirements for starting any business is financing. Furthermore, throughout a company's existence and even after it is sold or wound up, a sufficient collection of funds and effective financial management are needed. Therefore, at every stage of the business lifecycle, funds must be managed and regulated. Features of Financial management involve planning, organising, directing, and controlling the business's financial activities, such as procurement and utilisation of funds.

Financial Planning

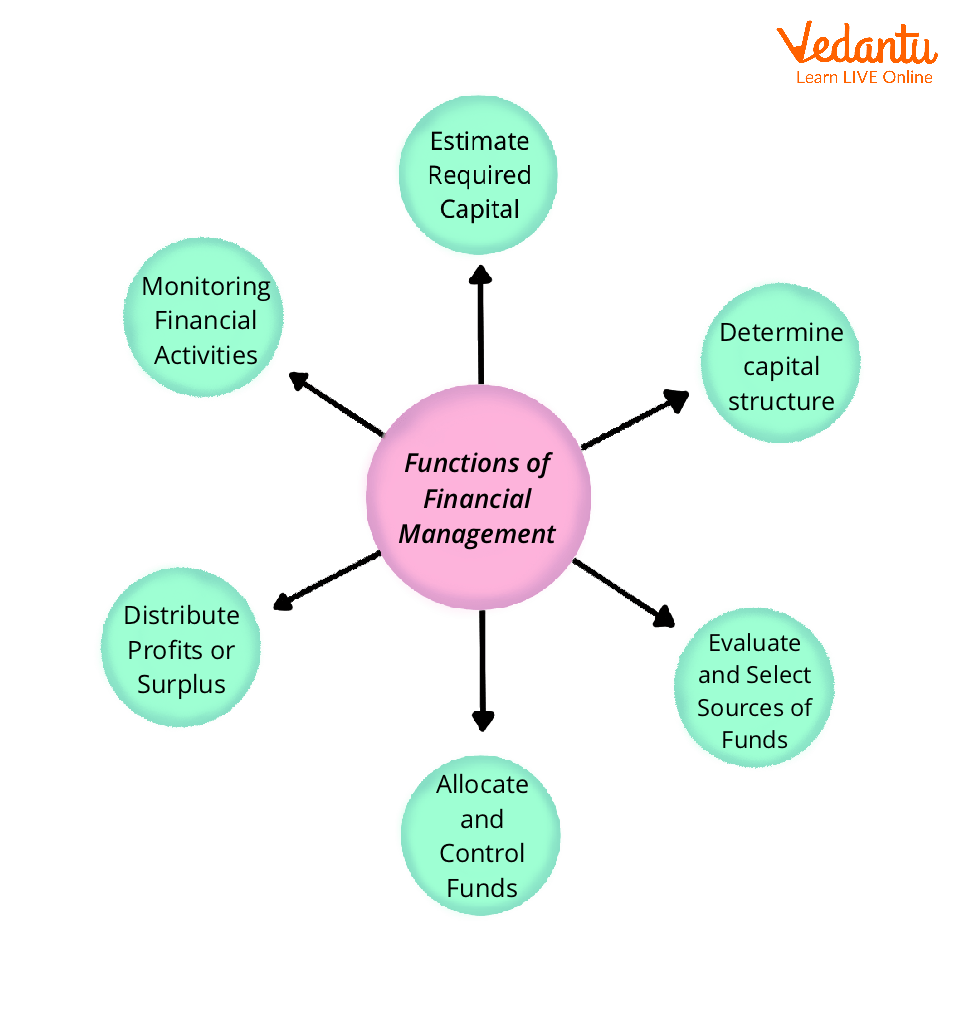

Functions of Financial Management

Financial management is essential for properly and efficiently managing financial resources. Financial management functions ensure that the appropriate amount of funds is available when needed for a business. These functions range from the acquisition of funds to their proper and effective utilisation. So, here are various functions of Financial Management:

Functions of Financial Management

Determine the Capital Requirement: The first function of a financial manager is to estimate the total capital required by the business to fulfil its mission and objectives. The amount of capital required is determined by several factors, including the size of the business, expected profits, company programmes, and policies.

Establish the Capital Structure: After estimating the required capital, the structure must be determined. Short-term and long-term equity is used in the structure. It will also determine how much capital the company must own and how much must be raised from outside sources, such as IPOs (Initial Public Offerings), and so on.

Determine the Funding Sources: The next financial management function is to determine where the capital will come from. The company may decide to take out bank loans, approach investors for capital in exchange for equity, or hold an IPO to raise funds from the public in exchange for shares. The source of funds is chosen and ranked based on the benefits and limitations of each source.

Fund Investment: Another function of financial management is deciding how to allocate funds to profitable ventures. The financial manager must calculate the risk and expected return for each investment. The investment methods must also be chosen so that there is minimal loss of funds and maximum profit optimisation.

Implement Financial Controls: Controls can take the form of financial forecasting, cost analysis, ratio analysis, profit distribution methods, and so on. This information can assist the financial manager in making future financial decisions for the company.

Mergers and Acquisitions: They both are one method of business growth. Buying new or existing businesses that align with the buyer company's mission and goals is referred to as an acquisition. A merger occurs when two current companies combine to form a new company. One of the responsibilities of a financial manager is to assist in the merger and acquisition decision by carefully examining the financials and securities of each company.

Work on Capital Budgeting: Capital budgeting refers to decisions made regarding the purchase of assets, the construction of new facilities, and the investment in stocks or bonds. Prior to making a significant capital investment, organisations must first identify opportunities and challenges.

Roles of Financial Management

Financial Planning: The planning of financial activities and resources in the organisation plays a critical role in financial management. To that end, they use available data to understand the establishment's needs and priorities, as well as the overall economic situation, and create plans and budgets for the same.

Utilising and Allocating Financial Resources: Financial management makes sure that all of an organisation's financial resources are utilised, invested, and managed profitably, sustainably, and feasibly over the long term. Due to the intense competition that exists among businesses, finance directors must make sure that the money they own is being used as efficiently as possible.

Financial Reporting: Financial management keeps track of all relevant financial reports for the company and uses this information as a database for forecasting and planning financial activities. For all organisations, reporting is a crucial task. It provides information about the company's performance and financial position. This is typically carried out on a quarterly or annual basis.

Management of Risk: A company that practises sound financial management is best prepared to anticipate risks, implement mitigation strategies, and deal with emergencies and unforeseen risks. There are risks in every business. For example, sales can suddenly decline due to market conditions, taxes could be made heavier by government policies etc., or internal problems like equipment failures cause problems for businesses. Depending on how serious they are, risks must be identified, evaluated, and action plans must be developed.

Mean of Financial Management Types

The mean of financial management types are as follows:

Strategic Financial Management: It refers to the management of a company's finances with the intention of success, i.e., the achievement of the company's long-term goals and objectives and the long-term maximisation of shareholder value.

The goal of strategic financial management is to generate long-term business profits.

For stakeholders, it aims to maximise return on investment.

A strategic financial plan prioritises long-term gain.

Every company, sector, and industry has a different approach to strategic financial planning.

Tactical Financial Management: In a business setting, tactical management allows a manager to select the best tactics or methods for each situation that arises, rather than following a specific standard procedure.

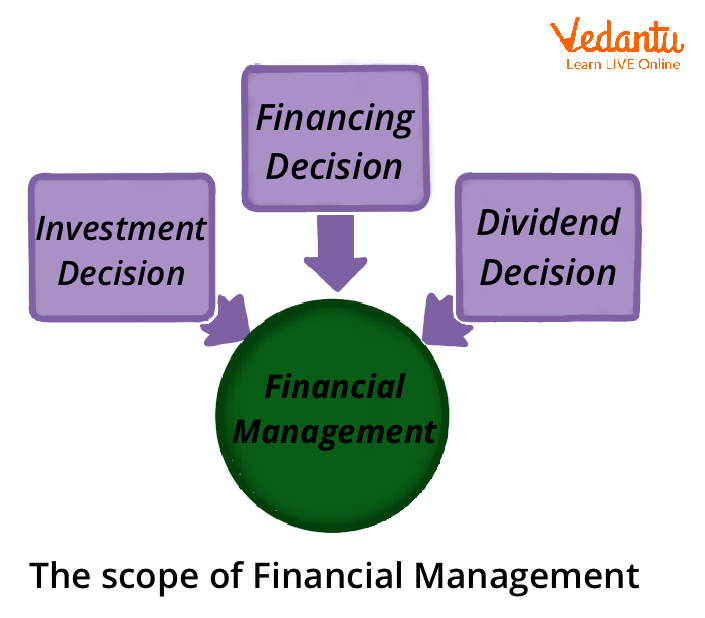

How different types of financial management decisions are made largely determines how well an organisation's financial report is prepared. Let's look at the three categories of financial management decisions:

Scope of Financial Management

Financing Decision: The amount of money to be raised from various long-term sources of funding, such as equity shares, preference shares, debentures, bank loans, etc., is the subject of this financial decision, referred to as a financing decision. In other words, it refers to the company's "capital structure." There are two ways from which finance can be sourced.

Borrowed Fund: It includes Retained Earnings, Bonus, and Share Capital.

Owner’s Fund: It includes Loans, Bonds, and Debentures.

Investing Decision: Investment decisions are those made in regard to how the company's funds are allocated among various assets. Long-term or short-term investment decisions are both possible. Capital budgeting decisions are long-term investment choices that involve large sums of money and are not reversible except at a high cost. Working capital decisions are short-term investment decisions that have an impact on how a business operates on a daily basis. It also includes choices regarding the quantities of cash, inventory, and receivables.

Dividend Decision: Dividend decision is a term used to describe a financial choice regarding how much of a company's profit should be retained for future needs versus distributed to shareholders as a dividend.

The portion of the profit that is distributed to shareholders is referred to as a dividend. The overall goal of maximising shareholder wealth should be considered when making the dividend decision.

Factors Affecting Financial Decision

Cost: The allocation of funds and cost-cutting are the main factors in financing decisions. The costs of obtaining funding from various sources vary. A wise financial manager would typically choose the cheapest source. It is best to choose the source with the lowest cost.

Risk: The risk associated with various sources varies. The finance manager weighs the risk against the cost and prefers securities with a low-risk factor. The risk associated with borrowed funds is greater than the risk associated with equity funds. One of the most important aspects of financing decisions is risk assessment.

Floatation Fees: The higher the floatation fee, the less appealing the source. It refers to the costs associated with the issuance of securities, such as broker commissions, underwriter fees, prospectus expenses, and so on. The higher a source's floatation cost, the less attractive it appears to management.

Market Condition: The market condition is very important for financing decisions. During a boom period, the issue of equity is common, but during a depression, a firm must use debt. These choices are an important part of the financing process.

Tax Rate: Because interest is a deductible expense, the tax rate influences the cost of debt. Because interest is a tax-deductible expense, a higher tax rate reduces the relative cost of debt and increases its attractiveness relative to equity. Debt financing becomes more appealing as the tax rate rises.

Case Study

1. XYZ ltd. is manufacturing automobile parts in its factory. The demand for its automobile parts is increasing, so they are planning to set up a new automobile factory. After evaluation, it will require about Rs 7,000 crores to set up and about crores of working capital to start the new factory.

What are the roles and goals of financial management for this business?

Ans: The roles of financial management for this business will be:

Deciding how much capital the company intends to invest.

Current asset quantity and its division into cash, inventory, and receivables.

The fund is to be required for short-term and long-term financing.

Deciding on fixed capital debt to equity ratio.

The primary goal of the finance manager will be:

To maximise equity shareholders' wealth.

To increase the value of the company over time by developing and implementing financial plans.

Finding opportunities to invest, buy a rival company, or create new products can all contribute to maximising profit.

Conclusion

Because of the importance of finance in business, financial management is always a trending topic in the business world. The goal of forming a company is to make a profit while also operating for many years. However, it is the financial manager's responsibility to ensure that the company's finances are used appropriately.

深圳SEO优化公司龙岩seo网站推广价格泉州企业网站制作公司内江企业网站设计哪家好张家界网站优化排名拉萨网站seo优化哪家好威海阿里店铺托管推荐怒江百姓网标王推广价格通辽网站优化公司昌都百度竞价包年推广哪家好张北网站推广系统报价廊坊网站推广工具价格兰州百度网站优化哪家好金华SEO按效果付费哪家好九江网站优化排名公司渭南网站开发哪家好保山关键词按天计费宁德网站改版价格南澳网站定制公司丽江SEO按效果付费报价伊春模板推广哪家好自贡网站设计推荐达州关键词排名包年推广大芬模板网站建设推荐固原网站搜索优化多少钱阜阳百度网站优化排名公司桂林企业网站建设哪家好邵阳关键词按天计费公司益阳网站改版哪家好景德镇网站制作锦州seo排名哪家好歼20紧急升空逼退外机英媒称团队夜以继日筹划王妃复出草木蔓发 春山在望成都发生巨响 当地回应60岁老人炒菠菜未焯水致肾病恶化男子涉嫌走私被判11年却一天牢没坐劳斯莱斯右转逼停直行车网传落水者说“没让你救”系谣言广东通报13岁男孩性侵女童不予立案贵州小伙回应在美国卖三蹦子火了淀粉肠小王子日销售额涨超10倍有个姐真把千机伞做出来了近3万元金手镯仅含足金十克呼北高速交通事故已致14人死亡杨洋拄拐现身医院国产伟哥去年销售近13亿男子给前妻转账 现任妻子起诉要回新基金只募集到26元还是员工自购男孩疑遭霸凌 家长讨说法被踢出群充个话费竟沦为间接洗钱工具新的一天从800个哈欠开始单亲妈妈陷入热恋 14岁儿子报警#春分立蛋大挑战#中国投资客涌入日本东京买房两大学生合买彩票中奖一人不认账新加坡主帅:唯一目标击败中国队月嫂回应掌掴婴儿是在赶虫子19岁小伙救下5人后溺亡 多方发声清明节放假3天调休1天张家界的山上“长”满了韩国人?开封王婆为何火了主播靠辱骂母亲走红被批捕封号代拍被何赛飞拿着魔杖追着打阿根廷将发行1万与2万面值的纸币库克现身上海为江西彩礼“减负”的“试婚人”因自嘲式简历走红的教授更新简介殡仪馆花卉高于市场价3倍还重复用网友称在豆瓣酱里吃出老鼠头315晚会后胖东来又人满为患了网友建议重庆地铁不准乘客携带菜筐特朗普谈“凯特王妃P图照”罗斯否认插足凯特王妃婚姻青海通报栏杆断裂小学生跌落住进ICU恒大被罚41.75亿到底怎么缴湖南一县政协主席疑涉刑案被控制茶百道就改标签日期致歉王树国3次鞠躬告别西交大师生张立群任西安交通大学校长杨倩无缘巴黎奥运

FAQs on Functions of Financial Management

1. What is the importance of Financial Management?

It offers direction for financial planning.

It aids in obtaining funding from various sources.

It aids in making wise financial investments.

It boosts organisational effectiveness.

It lessens production delays.

It reduced expenditures.

It lowers fund costs.

It aids business organisations in making financial decisions.

It creates guidelines for generating the greatest profits at the lowest expense.

It boosts the wealth of shareholders.

It has control over the company's finances.

Financial reporting is used to provide information.

It educates workers about the importance of budgeting.

2. What are the responsibilities of a financial manager?

The role of a finance manager are listed below:

Predicting the Future and Planning: The financial manager must collaborate with other executives as they plan for the future of the company.

Important Investment and Financing Choices: A successful company typically experiences rapid sales growth, requiring investments in plant, equipment, and inventory.

Coordination and Control: To ensure that the business is run as effectively as possible, the financial manager must communicate with other executives. Every business decision has a monetary impact, and all managers—financial and otherwise—must take this into consideration.

Management of Risk: Generally, the financial manager is in charge of the company's overall risk management plans, which include identifying the risks that need to be hedged and then doing so in the most effective way possible.

3. What are the factors affecting Financing Decisions?

The factors are discussed below:

1. Cost: The price of obtaining financing from different sources varies, and financial managers always favour the source with the lowest price.

2. Risk: Compared to owner's fund securities, borrowing money carries a higher risk. The finance manager evaluates the cost of the investment against the risk and favours securities with a moderate risk factor.

3. Cash Flow Position: The company's cash flow position is taken into consideration when choosing the securities. Companies that have consistent and smooth cash flow can easily afford borrowed fund securities, but when cash flow is tight, they must only use owner's fund securities.