Porter five forces analysis is a framework that attempts to analyze the level of competition within an industry and business strategy development. It draws upon industrial organization (IO) economics to derive five forces that determine the competitive intensity and therefore attractiveness of an Industry. Attractiveness in this context refers to the overall industry profitability. An “unattractive” industry is one in which the combination of these five forces acts to drive down overall profitability. A very unattractive industry would be one approaching “pure competition”, in which available profits for all firms are driven to normal profit. This analysis is associated with its principal innovator Michael E. Porter of Harvard University.

波特五力分析是一个试图分析行业内竞争水平和业务战略发展的框架。它利用产业组织(IO)经济学得出了五种力,这些力决定了一个行业的竞争强度和吸引力。在这种情况下的“吸引力”指的是整个行业的盈利能力。“没有吸引力”的行业是指这五种力量的结合会降低整体盈利能力的行业。一个非常没有吸引力的行业将是一个接近“纯竞争”的行业,在这个行业中,所有公司的可用利润都被驱赶到正常利润。这项分析与哈佛大学的主要创新者迈克尔·E·波特(Michael E. Porter)有关。

Porter referred to these forces as the micro environment, to contrast it with the more general term macro environment. They consist of those forces close to a company that affect its ability to serve its customers and make a profit. A change in any of the forces normally requires a business unit to re-assess the marketplace given the overall change in industry information. The overall industry attractiveness does not imply that every firm in the industry will return the same profitability. Firms are able to apply their core competencies, business model or network to achieve a profit above the industry average. A clear example of this is the airline industry. As an industry, profitability is low and yet individual companies, by applying unique business models, have been able to make a return in excess of the industry average.

波特将这些力称为微观环境,以将其与更一般的宏观环境进行对比。它们由那些与公司关系密切的力组成,这些力会影响公司为客户提供服务和赚取利润的能力。考虑到行业信息的整体变化,任何力的变化通常都需要业务部门重新评估市场。整个行业的吸引力并不意味着该行业的每家公司都会获得相同的盈利能力。航空业就是一个明显的例子。作为一个行业,盈利能力很低,但个别公司通过应用独特的 商业模式,能够获得超过行业平均水平的回报。

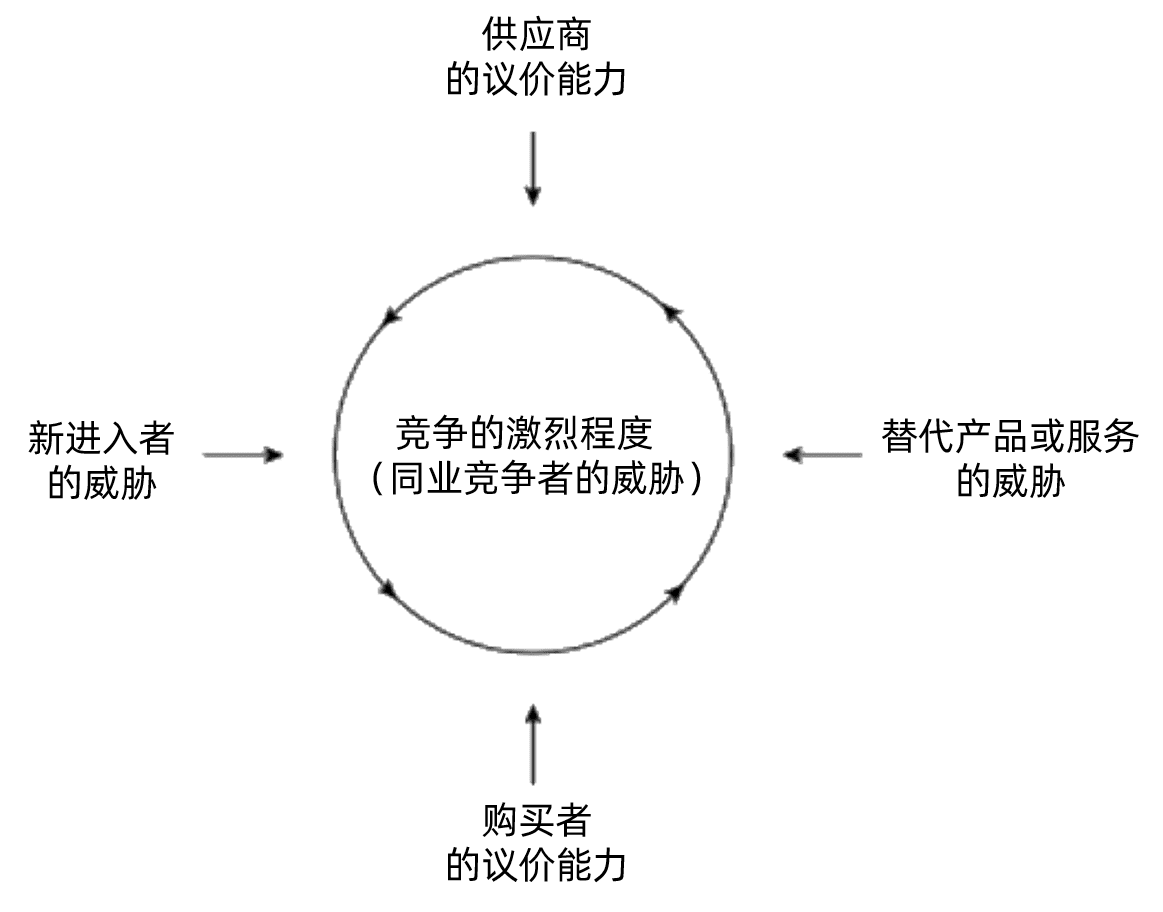

Porter’s five forces include – three forces from ‘horizontal’ competition: the threat of substitute products or services, the threat of established rivals, and the threat of new entrants; and two forces from ‘vertical’ competition: the bargaining power of suppliers and the bargaining power of customers.

波特的五力包括:来自“横向”竞争的三种力:替代产品或服务的威胁、同业竞争者的威胁和新进入者的威胁;以及来自“垂直”竞争的两种力量:供应商的议价能力和购买者的议价能力。

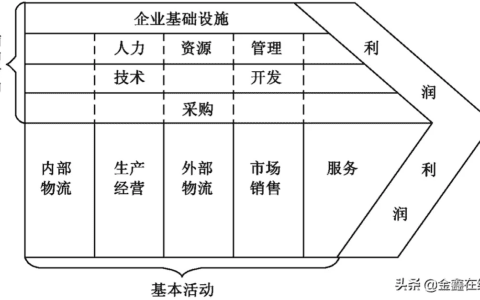

Porter developed his Five Forces analysis in reaction to the then-popular SWOT analysis, which he found unrigorous and ad hoc.[1] Porter’s five forces is based on the Structure-Conduct-Performance paradigm in industrial organizational economics. It has been applied to a diverse range of problems, from helping businesses become more profitable to helping governments stabilize industries.[2] Other Porter strategic frameworks include the value chain and the generic strategies.

波特开发了五力分析,以回应当时流行的SWOT分析。他发现SWOT分析不严谨,而且是临时性的。[1]波特五力是基于产业组织经济学中的结构-行为-绩效范式。它被应用于(处理)各种各样的问题,它被应用于各种各样的问题,从帮助企业变得更有利可图到帮助政府稳定行业。[2] 波特的其他战略框架包括价值链和通用战略。

Five forces

五力

Threat of new entrants

新进入者的威胁

Profitable markets that yield high returns will attract new firms. This results in many new entrants, which eventually will decrease profitability for all firms in the industry. Unless the entry of new firms can be blocked by incumbents (which in business refers to the largest company in a certain industry, for instance, in telecommunications, the traditional phone company, typically called the “incumbent operator”😉, the abnormal profit rate will trend towards zero (perfect competition).

高回报的有利可图的市场将吸引新公司。这会吸引许多新进入者,最终将降低该行业所有公司的盈利能力。除非新公司的进入可以被主导运营商阻止(在商业中指的是某一行业中最大的公司,例如电信业,传统的电话公司,通常被称为“主导运营商”),反常利润率将趋向于零(完全竞争)。

The following factors can have an effect on how much of a threat new entrants may pose:

以下因素可能会影响新进入者可能构成的威胁程度:

The existence of barriers to entry (patents, rights, etc.). The most attractive segment is one in which entry barriers are high and exit barriers are low. Few new firms can enter and non-performing firms can exit easily.

存在进入壁垒(专利、版权等)。最具吸引力的市场是进入壁垒高、退出壁垒低的市场。(只有)少量新公司可以进入,而运转不佳的公司会轻易退出。

Government policy

政府政策

Capital requirements

资本要求

Absolute cost

绝对成本

Cost disadvantages independent of size

与公司规模无关的成本劣势

Economies of scale

规模经济

Economies of product differences

产品差异经济

Product differentiation

产品差异化

Brand equity

品牌资产

Switching costs or sunk costs

转换成本或沉没成本

Expected retaliation

预期回报

Access to distribution

获得分销渠道

Customer loyalty to established brands

顾客对知名品牌的忠诚度

Industry profitability (the more profitable the industry the more attractive it will be to new competitors)

行业盈利能力(行业盈利越高,对新进的竞争对手的吸引力就越大)

Threat of substitute products or services

替代产品或服务的威胁

The existence of products outside of the realm of the common product boundaries increases the propensity of customers to switch to alternatives. For example, tap water might be considered a substitute for Coke, whereas Pepsi is a competitor’s similar product. Increased marketing for drinking tap water might “shrink the pie” for both Coke and Pepsi, whereas increased Pepsi advertising would likely “grow the pie” (increase consumption of all soft drinks), albeit while giving Pepsi a larger slice at Coke’s expense. Another example is the substitute of a landline phone with a cellular phone.

“公共产品领域边界之外的产品”增加了客户转向替代品的倾向。例如,除百事可乐外,自来水也可能被视为可口可乐的替代品。增加饮用自来水的营销可能会“缩小”可口可乐和百事可乐的市场份额,而增加百事可乐的广告可能会“扩大市场份额”(增加所有软饮料的消费),尽管如此,可口可乐却为百事可乐提供了更大的份额。另一个例子是用手机代替固定电话。

Potential factors:

潜在因素:

Buyer propensity to substitute

买方选择替代品的倾向

Relative price performance of substitute

替代品的相对价格表现

Buyer switching costs

买房的转换成本

Perceived level of product differentiation

感知产品的差异化的水平

Number of substitute products available in the market

市场上可用的替代产品数量

Ease of substitution

易替换性(替代难度)

Substandard product

次品

Quality depreciation

质量折旧

Availability of close substitute

相似替代品的可获得性

Bargaining power of customers (buyers)

购买者的议价能力

The bargaining power of customers is also described as the market of outputs: the ability of customers to put the firm under pressure, which also affects the customer’s sensitivity to price changes. Firms can take measures to reduce buyer power, such as implementing a loyalty program. The buyer power is high if the buyer has many alternatives. The buyer power is low if they act independently e.g. If a large number of customers will act with each other and ask to make prices low the company will have no other choice because of large number of customers pressure.

买家的议价能力也被描述为产出市场:买家给公司带来压力的能力,它也会影响买家对价格变化的敏感性。公司可以采取措施来降低来自买家的议价能力,比如实施忠诚度计划。如果买家有很多选择,那么买家的议价能力就很高。如果买家独自行事,他的议价能力就低。如果大量买家相互交流,要求降低价格,由于大量用户的压力,公司将没有其他选择。

Potential factors:

潜在因素:

Buyer concentration to firm concentration ratio

买家集中度与公司集中度指数

Degree of dependency upon existing channels of distribution

对现有分销渠道的依赖程度

Bargaining leverage, particularly in industries with high fixed costs

议价的杠杆作用,特别是在固定成本较高的行业

Buyer switching costs relative to firm switching costs

买家相对于公司的转换成本

Buyer information availability

买家信息可获得性

Force down prices

降低价格的力度

Availability of existing substitute products

现有替代产品的可用性

Buyer price sensitivity

买家价格敏感性

Differential advantage (uniqueness) of industry products

行业产品的差异优势(独特性)

RFM (customer value) Analysis

RFM(客户价值)分析

The total amount of trading

交易量

注:集中度指数:某行业的相关市场内前N家最大的企业所占市场份额(产值、产量、销售额、销售量、职工人数、资产总额等)的总和,是对整个行业的市场结构集中程度的测量指标,用来衡量企业的数目和相对规模的差异,是市场势力的重要量化指标。

Bargaining power of suppliers

供应商的议价能力

The bargaining power of suppliers is also described as the market of inputs. Suppliers of raw materials, components, labor, and services (such as expertise) to the firm can be a source of power over the firm when there are few substitutes. If you are making biscuits and there is only one person who sells flour, you have no alternative but to buy it from them. Suppliers may refuse to work with the firm or charge excessively high prices for unique resources.

供应商的议价能力也被描述为投入品市场。在几乎没有替代品的情况下,给公司提供原材料、组件、劳动力和服务(如专业知识)的供应商,会成为公司的议价能力来源。如果你在做饼干,而只有一个人卖面粉,你别无选择,只能从他们那里买。供应商可能会拒绝与公司合作,或对独特的资源收取过高的价格。

Potential factors are:

潜在因素:

Supplier switching costs relative to firm switching costs

供应商相对于公司的转换成本

Degree of differentiation of inputs

投入品的差异程度

Impact of inputs on cost or differentiation

投入品对成本或差异的影响

Presence of substitute inputs

存在投入品的替代品

Strength of distribution channel

分销渠道的实力

Supplier concentration to firm concentration ratio

供应商集中度和公司集中度指数

Employee solidarity (e.g. labor unions)

员工相互支持(如,工会)

Supplier competition: the ability to forward vertically integrate and cut out the buyer.

供应商竞争:向前垂直整合并切断买方的能力。

Intensity of competitive rivalry

竞争的激烈程度(同业竞争者的威胁)

For most industries the intensity of competitive rivalry is the major determinant of the competitiveness of the industry.

对于大多数行业来说,竞争的激烈程度是行业竞争力的主要决定因素。

Potential factors:

潜在因素:

Sustainable competitive advantage through innovation

通过创新获得可持续竞争优势

Competition between online and offline companies

线上和线下公司之间的竞争

Level of advertising expense

广告支出水平

Powerful competitive strategy

强有力的竞争战略

Firm concentration ratio

企业集中度指数

Degree of transparency

透明度

Usage

用法

Strategy consultants occasionally use Porter’s five forces framework when making a qualitative evaluation of a firm’s strategic position. However, for most consultants, the framework is only a starting point or “checklist.” They might use value chain or another type of analysis in conjunction.[3] Like all general frameworks, an analysis that uses it to the exclusion of specifics about a particular situation is considered naive.

战略顾问在对公司战略地位进行定性评估时,偶尔会使用波特五力框架。然而,对于大多数顾问来说,该框架只是一个起点或“清单”他们可能会结合使用价值链或其他类型的分析。[3] 与所有通用框架一样,使用它来排除特定情况的细节的分析被认为是幼稚的。

According to Porter, the five forces model should be used at the line-of-business industry level; it is not designed to be used at the industry group or industry sector level. An industry is defined at a lower, more basic level: a market in which similar or closely related products and/or services are sold to buyers. (See industry information.) A firm that competes in a single industry should develop, at a minimum, one five forces analysis for its industry. Porter makes clear that for diversified companies, the first fundamental issue in corporate strategy is the selection of industries (lines of business) in which the company should compete; and each line of business should develop its own, industry-specific, five forces analysis. The average Global 1,000 company competes in approximately 52 industries (lines of business)[citation needed].

波特认为,五力模型应该在行业层面上使用;其设计目的不是用于行业集团或行业部门层面。行业被定义在一个较低、更基本的层面上:向买家出售类似或密切相关产品和/或服务的市场。(参见行业信息。)在单一行业竞争的公司应至少为其行业制定一个五力分析。波特明确表示,对于多元化公司来说,公司战略中的第一个基本问题是选择公司应该竞争的行业(业务线);每个行业都应该制定自己的行业特定五力分析。平均全球1000家公司在大约52个行业(业务线)竞争[需要引证]。

Criticisms

批评

Porter’s framework has been challenged by other academics and strategists such as Stewart Neill. Similarly, the likes of ABC, Kevin P. Coyne [1] and Somu Subramaniam have stated that three dubious assumptions underlie the five forces:

波特的框架受到了斯图尔特·尼尔(Stewart Neill)等其他学者和战略家的挑战。类似地,ABC、Kevin P.Coyne[1]和Somu Subramaniam等人也表示,这五种力背后有三个可疑的假设:

That buyers, competitors, and suppliers are unrelated and do not interact and collude.

买家、竞争对手和供应商是不相关的,不会相互影响和勾结。

That the source of value is structural advantage (creating barriers to entry).

价值的来源是结构优势(创造进入壁垒)。

That uncertainty is low, allowing participants in a market to plan for and respond to competitive behavior.[4]

这种不确定性很低,市场参与者可以为竞争行为制定计划并做出反应。[4]

An important extension to Porter was found in the work of Adam Brandenburger and Barry Nalebuff of Yale School of Management in the mid-1990s. Using game theory, they added the concept of complementors (also called “the 6th force”😉, helping to explain the reasoning behind strategic alliances. Complementors are known as the impact of related products and services already in the market. [5]The idea that complementors are the sixth force has often been credited to Andrew Grove, former CEO of Intel Corporation. According to most references, the sixth force is government or the public. Martyn Richard Jones, whilst consulting at Groupe Bull, developed an augmented 5 forces model in Scotland in 1993. It is based on Porter’s model and includes Government (national and regional) as well as Pressure Groups as the notional 6th force. This model was the result of work carried out as part of Groupe Bull’s Knowledge Asset Management Organisation initiative.

20世纪90年代中期,耶鲁大学管理学院的亚当·勃兰登伯格(Adam Brandenburger)和巴里·纳勒布夫(Barry Nalebuff)的工作中发现了波特的一个重要延伸。利用博弈论,他们加入了互补者(也称为“第六力”)的概念,帮助解释战略联盟背后的原因。互补者被称为市场上已有的相关产品和服务的影响。[5] 互补者是第六种力的观点经常被归功于英特尔公司前首席执行官安德鲁·格罗夫(Andrew Grove)。根据大多数参考资料,第六种力是政府或公众。马丁·理查德·琼斯(Martyn Richard Jones)在波尔集团(Groupe Bull)担任顾问期间,于1993年在苏格兰开发了一个增强的五力模型。他以波特的模型为基础,包括政府(国家和地区)以及压力团体作为概念上的第六种力。该模型是Groupe Bull知识资产管理组织倡议的一部分成果。

Porter indirectly rebutted the assertions of other forces, by referring to innovation, government, and complementary products and services as “factors” that affect the five forces.[6]

波特间接驳斥了”其他的力“的说法,他将创新、政府、互补产品和服务称为影响这五种力的“因素”。[6]

It is also perhaps not feasible to evaluate the attractiveness of an industry independent of the resources a firm brings to that industry. It is thus argued (Wernerfelt 1984)[7] that this theory be coupled with the Resource-Based View (RBV) in order for the firm to develop a much more sound strategy. It provides a simple perspective for accessing and analyzing the competitive strength and position of a corporation, business or organization.

独立于企业为该行业带来的资源,评估该行业的吸引力也可能是不可行的。因此,有人认为(Wernerfelt 1984)[7]该理论应与基于资源的观点(RBV)相结合,以便企业制定更合理的战略。它为访问和分析公司、企业或组织的竞争力和地位提供了一个简单的视角。

参考文献:

- Michael Porter, Nicholas Argyres, Anita M. McGahan, “An Interview with Michael Porter”, The Academy of Management Executive 16:2:44 at JSTOR

- Michael Simkovic, Competition and Crisis in Mortgage Securitization

- Tang, David (21 October 2014). “Introduction to Strategy Development and Strategy Execution”. Flevy. Retrieved 2 November 2014.

- Kevin P. Coyne and Somu Subramaniam, “Bringing discipline to strategy”, The McKinsey Quarterly, 1996, Number 4, pp. 14-25 http://www.investopedia.com/terms/s/six-forces-model.asp

- Michael E. Porter. “The Five Competitive Forces that Shape Strategy”, Harvard Business Review, January 2008, p.86-104. PDF

- Wernerfelt, B. (1984), A resource-based view of the firm, Strategic Management Journal, Vol. 5, (April–June): pp. 171-180

本文经授权发布,不代表增长黑客立场,如若转载,请注明出处:https://www.growthhk.cn/quan/67865.html

微信扫一扫

微信扫一扫  支付宝扫一扫

支付宝扫一扫  财经洞察

财经洞察 财经洞察

财经洞察 财经洞察

财经洞察 财经洞察

财经洞察 财经洞察

财经洞察 财经洞察

财经洞察